Deloitte Malaysia 's Q&A on Budget 2010

by Financial Daily on Tuesday, 27 October 2009 03:40

KUALA LUMPUR: Following the tabling of Budget 2010 last Friday, Deloitte Malaysia worked together with The Edge Financial Daily to enlighten readers on how the various proposals would impact tax payers and consumers. The following are the answers provided by Janice Tan and Lee Chong Hoo of Deloitte Malaysia based on queries sent in by our readers.

Question 1: What is the impact on a worker earning, say, RM5,000 per month pursuant to Budget 2010?

A: He would not benefit from the proposed one percentage point reduction in the personal income tax rate from 27% to 26% as his chargeable income does not exceed RM100,000.

However, he would be entitled to claim the following additional/new tax reliefs proposed:-

• additional personal relief of RM1,000 (an increase from RM8,000 to RM9,000);

• additional relief of RM1,000 for premium paid on annuity scheme from insurance companies (please refer to further details in our answer to question 2 below);

• new relief on broadband subscription fee paid of up to RM500 per year for years 2010 to 2012.

Q2: How does the proposed additional relief of RM1,000 for premium paid on annuity scheme work and what annuity scheme will it encompass?

A: The additional relief of RM1,000 is in respect of premium paid on annuity scheme from insurance companies contracted from Jan 1, 2010 or additional premium paid on existing annuity scheme from Jan 1, 2010.

This is on top of the existing relief for premiums paid on life insurance or annuity scheme and contributions to the Employees Provident Fund (EPF) of RM6,000.

Where the premium paid on the new annuity scheme or the additional premium paid on existing scheme exceeds RM1,000, the excess can be claimed against any unutilised amount for the existing relief of RM6,000, subject to a cap of RM7,000 for the aggregate amount claimed.

The annuity scheme for the purposes of the above relief under Section 49(1) of the Income Tax Act 1967 (ITA) is an annuity scheme contracted for with an insurance company for securing on death a deferred annuity and not the existing annuity purchased through EPF Annuity Scheme. Currently, a separate relief of RM1,000 is given for the premium paid on the EPF Annuity Scheme under Section 49(1C) of the ITA.

Q3: I understand that Real Property Gains Tax (RPGT) will be reinstated from Jan 1, 2010. Is the 5% tax rate as announced in the budget a fixed rate regardless of the holding period of the properties? Will this just apply to an individual?

A: Notwithstanding the proposals in the Finance Bill, the Ministry of Finance has confirmed that a 5% rate of RPGT irrespective of the holding period and category of tax payers, ie whether individuals or companies, will be introduced through a Ministerial Exemption Order effective Jan 1, 2010.

Q4: I have an apartment under the joint names of my son and myself. I wish to change the ownership in the apartment to either be:-

a) jointly owned by my daughter and myself, or

b) solely owned by my daughter.

Will the above proposed transfers be subject to RPGT based on the Budget 2010 proposals?

A: The transfer of ownership from yourself to your daughter under (b) will be regarded as a gift between parent and child and thus will be exempted from RPGT.

However, the above exemption by way of gift does not cover the transfer of ownership from your son to your daughter. Your son may choose to exercise the once-in-a-lifetime exemption from RPGT for disposal of private residence.

Q5: What will be my obligations if I were to acquire a property after Jan 1, 2010 for a total consideration of, say, RM500,000?

A: You would need to withhold the lower of the amount of money consideration or 2% of the total consideration and remit the sum to the Inland Revenue Board (IRB) within 60 days from the date of disposal. Assuming the total consideration of RM500,000 consists wholly of cash, the amount required to be withheld and remitted would be RM10,000. In addition, you would also be required to submit a return on acquisition of chargeable asset under the existing requirement of the RPGT Act 1976.

Q6: Will my obligation be different if my purchase consideration is partly in cash, say, RM5,000 and the balance is paid by way of shares?

A: The amount required to be withheld and remitted to the IRB will be reduced to the whole amount of the money consideration of RM5,000 and not 2% of the total consideration.

Q7: What will happen if I do not fulfil my obligations as an acquirer under the RPGT Act?

A: Failure to comply with the above withholding requirement would result in a 10% penalty to be imposed on the acquirer and the withholding due plus the penalty would be regarded as a debt due from the acquirer to the government.

Q8: If I sell two properties, one at a profit of RM50,000 and another at a loss of RM15,000 in the same year, what is my chargeable gain?

A: It is proposed under Budget 2010 that any allowable loss arising from a disposal of a chargeable asset would be deducted against any chargeable gain arising from subsequent disposals. As such, your chargeable gain would be RM35,000 after deducting the allowable loss of RM15,000.

Q9: Currently I have two credit cards, one from Citibank and the other from CIMB. I am the principal card holder while my wife and two children are secondary card holders from both banks. I heard that I will be imposed a service tax on such cards effective from Jan 1, 2010. How will it affect me?

A: Effective from Jan 1, 2010, service tax of RM50 and RM25 would be imposed annually for each principal and secondary card respectively. As such, you would be subject to service tax totalling RM250 annually [(RM50 x 2) + (RM25 x 3 x 2)] for the above principal and secondary cards

Q10: I understand that tax incentives for health tourism would be enhanced whereby the exemption rate of 50% on the value of increased exports would be increased to 100% subject to 70% of the statutory income for each year of assessment? How does the exemption work and what would constitute exports for the purposes of the above exemption?

A: The amount of income to be exempted is computed based on the increase in the value of qualifying services exported for two consecutive basis periods.

Assuming the values of services qualifying for exemption are RM100,000 and RM200,000 for Year 1 and Year 2 respectively, the value of increased exports would be RM100,000 ie (RM200,000 — RM100,000).

As such, the amount of income to be exempted for the above example under the Budget 2010 proposal would be RM100,000 instead of RM50,000 based on the existing 50% exemption rate.

The above amount exempted would be allowed as a deduction against the person’s statutory business income (SI) in arriving at the chargeable income but is restricted to 70% of the SI for that year of assessment. Any unutilised amount can be carried forward to be deducted against future statutory income. Normally, statutory business income is computed by deducting allowable expenses and capital allowances from the gross income of the business.

To qualify for the aforesaid exemption, the healthcare services must be provided to the following foreign clients in Malaysia :

a) A company, a partnership, an organisation or a cooperative society incorporated or registered outside Malaysia ;

b) Non-Malaysian citizens who do not hold Malaysian work permits; or

c) Malaysian citizens who are non-residents living abroad.

For the purposes of the enhanced incentive, foreign clients would now exclude:

a) A non-Malaysian citizen that participates in Malaysia My Second Home Programme and his dependents;

b) A non-Malaysian citizen holding a Malaysian student pass and his dependents;

c) A non-Malaysian citizen holding a Malaysian work permit and his dependents; or

d) Malaysian citizens who are non-residents living abroad and his dependents.

However, healthcare services providers who are currently providing services to foreign clients who are excluded under the enhanced incentive can continue to enjoy the existing incentives.

This article appeared in The Edge Financial Daily, October 27, 2009.

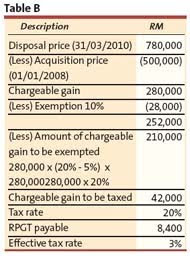

The comparison of taxes payable shows a tax saving of RM100,000 calculated as seen in the table.

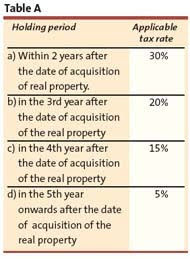

The comparison of taxes payable shows a tax saving of RM100,000 calculated as seen in the table.  In the Budget 2010 speech, the Government’s intention was clear. It is to ensure that the Malaysian tax system is equitable and continue to be able to generate revenue for development purposes. In line with this, the Government proposed that a tax of 5% be imposed on gains from the disposal of real property from Jan 1 2010. Any agreements signed between now till Dec 31 remains RPGT exempted.

In the Budget 2010 speech, the Government’s intention was clear. It is to ensure that the Malaysian tax system is equitable and continue to be able to generate revenue for development purposes. In line with this, the Government proposed that a tax of 5% be imposed on gains from the disposal of real property from Jan 1 2010. Any agreements signed between now till Dec 31 remains RPGT exempted.

[x – x(y - 5%)/y ] y =xy – xy + 5% x

[x – x(y - 5%)/y ] y =xy – xy + 5% x